Are you struggling with money? Do you feel a sense of chaos when it comes to your finances? Do you feel called to give more but can’t seem to come up with the money?

Well then, you need a budget!

A budget is just the beginning of a plan to manage God’s money. (verse?)

What is a Budget?

A budget is an overview of and plan for God’s money. You can think of a budget as a goal.

For example, if your budget for groceries is $300 per month, it’s your goal to stay within that amount. You may not always obtain that goal, but you’ll always be aiming for it and it can be adjusted.

A budget is not simply one category, although you certainly could focus on one thing. Your budget will include all your bills and other expenses, plus any savings you plan for.

A budget can be as simple or as detailed as you want, as long as it’s easy to follow. In another post, I’ll show you different methods for budgeting so you can decide what works best for you.

What every budget needs

1. Income

Before you start your budget, you need to know how much money you’re making.

Check your bank account to get the exact amount for each paycheck.

If you want to budget monthly, you’ll just add all your paychecks for one month.

I prefer to budget on a monthly basis because it feels more straightforward. I don’t like being super detailed, but some people do.

In this* post, I discuss my preferred method and the pros and cons of monthly budgeting versus budgeting each paycheck.

2. Bills/Fixed Expenses

Next, you need to know every bill you have and how much it is.

Depending on what budgeting method you choose, you may also want to know the due date.

You can also include any expenses that do not change that aren’t necessarily bills. Include your regular monthly debt payments.

Examples would be your rent or mortgage, internet bill, and car insurance.

Don’t forget any bills that you pay on a yearly basis. If this is the month that the bill is due, put it in this section.

I like to include my electric/water bill here because I don’t budget for it. (That’s not to say I don’t try to reduce that bill!) Some people like to make this a budget category instead.

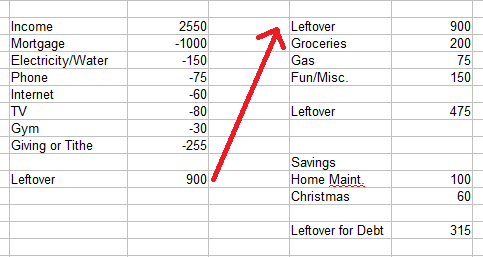

Below is a fictional list of expenses you might have.

| FIXED EXPENSES | |

| Mortgage | 1000 |

| Electricity | 150 |

| Phone | 75 |

| Internet | 60 |

| TV | 80 |

| Gym | 30 |

| Giving or Tithe | 255 |

3. Budget Categories

You will need to think of all the things you spend money on that vary from month to month. Examples include groceries, gas, and clothing.

You can be as general or as specific as you want. How many categories you have really depends on your personality and how detailed you want your budget to be.

I have five or six categories, some of which encompass more than one thing. For example, I include clothing expenses in my “miscellaneous” category because I don’t buy clothes often.

I typically don’t change my categories from month to month, but you might. Let’s say next month you have a birthday party to attend. You may want to budget for a gift.

I like to save all year long for things like this instead, so you’ll see that in the next section.

| Groceries | 200 |

| Gas | 75 |

| Fun/Misc | 100 |

4. Savings Funds

Decide what things you want to save for and list them out. Examples include Christmas gifts, car maintenance, and vacation.

Some people like to call these “sinking funds.” If your fund is for something that happens yearly, you’ll need to decide how much you want to save for the year and then divide by 12 for your monthly amount.

You may have a fund that is a just-in-case fund, such as for home maintenance. For now, my home maintenance fund is simply a reserve for when I need to purchase something like fertilizer or new bed sheets.

Another example would be the gifts I mentioned in the last section. I set aside a little each month for when I have a need to buy a gift.

Here are x number of things you may want to save for.

| Home Maintenance | 100 |

| Christmas | 60 |

5. Debts

If you have debts and paying them off early is your goal, you’ll want to list them out and include how much is left and the interest rate. The interest rate will help you decide the order in which to pay them.

(In this post I discuss how to choose the order in which to pay off your debts.)

When closing out your budget each cycle, you’ll decide how much extra you’d like to contribute to paying off your debts.

If you are not paying off debts early, or you want to contribute the same amount every month, you don’t need this section. Just include whatever you regularly pay in the fixed expenses section.

| Category | Rate |

| Mortgage | 4.75% |

How to Make a Budget

Now that you have all that information, you’re ready to get started.

Let’s take a look at the categories from the above sections and put them together.

Obviously, this is a very simple list, and most people have a messier budget. If you want to see a real-life budget, check out my real-life budget section.

This is just one way to plan your budget. There are many different ways to create a budget, I just prefer to use an excel spreadsheet.

As you can see, once you’ve done the work on the first four sections of your budget, you’ll know how much extra you can afford to put toward your debt.

In this example, let’s do the math.

Income – (total fixed expenses) – (total budget categories) – (total savings) = total available for debt

2550 – 1650 – 425 – 160 = 315

Hopefully, you have a clearer vision of your finances now. Remember, this is just a plan; next comes putting the plan into action.

Need help with that part? Check out these other articles!

- Cash or Credit? Is one better for budgeting?

- x number of ways to save on groceries

- Stop buying these things to save money

- Check your heart: is that purchase really necessary?